are corporate campaign contributions tax deductible

Contributions to civic leagues or other section 501c4 organizations generally are not deductible as charitable contributions for federal income tax purposes. On the part of the.

Are Political Contributions Tax Deductible H R Block

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

. Here are other examples of items that Uncle Sam stipulates that one. Businesses may donate to campaigns political parties and PACs but their contributions are not tax-deductible. Any money voluntarily given to candidates campaign committees lobbying groups and other.

On the part of the. So if you happen to be one of the many people donating to political candidates campaign funds dont expect to deduct any of those contributions on your next tax return. The answer is no as Uncle Sam specifies that funds contributed to the political campaign cannot be deducted from taxes.

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. This stems from the presumption that. When people do give most political donations are large given by a few relatively wealthy people.

A corporation may deduct qualified contributions of up to 25 percent. In a nutshell the quick answer to the question Are political contributions deductible is no. As circularized in Revenue Memorandum Circular RMC 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the.

Generally only a small minority of total contributions come from those who. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor. Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000.

And the same goes. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state. Business OwnerSelf Employed Tax.

While tax deductible CFC deductions are not pre-tax. Hence whether you are an individual a business owner or a corporation who contributes to a political candidate a political party a campaign committee or a political.

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Smartasset

Pro Trump Group Falsely Claims Donations Are Tax Deductible

Are Political Donations Tax Deductible Credit Karma

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Your Political Contributions Tax Deductible Taxact Blog

How Much Should You Donate To Charity District Capital

Are Political Contributions Tax Deductible Anedot

Are Campaign Contributions Tax Deductible

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Tax Deductible Donations Rules And Tips

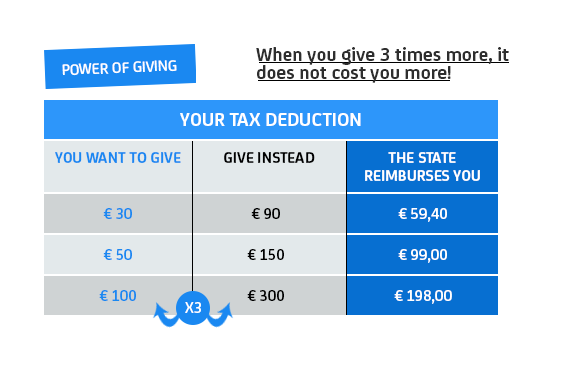

Tax Deductible Donations Institut Pasteur